Korean ‘Han river’ miracle is now over

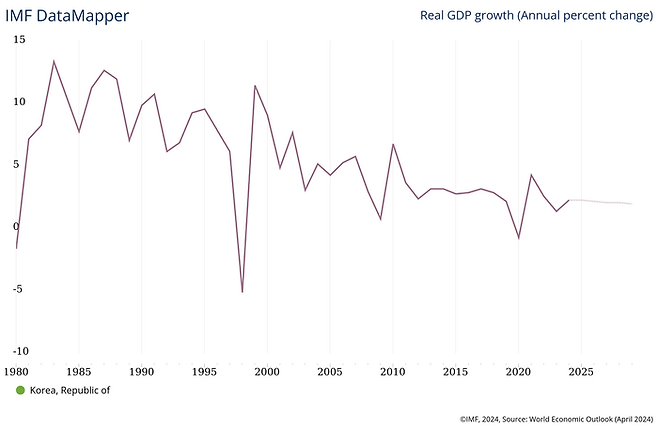

Korean GDP growth was 6.4%/y for 50 years until 2022, but down to 2.1%/y in 2020s.

Due to low birthrate down to 0.7, population is expected to 1/2 in 30 years.

Policy fails due to nationwide preference to leftwing agenda.

Few globally competent companies leave the country.

Financial Times, on Apr 22, 2024, reported that South Korean economic miracle is about to be over. The claim is simple. The 50 years of economic growth from 1970 to 2022 with 6.4%/year is replaced by mere 2.1%/year growth in 2020s, and it will be down to 0.6% in the 2030s and 0.1% in 2040s.

For a Korean descendent, it is no secret that the country’s economy has never been active since 1997 when Asian financial crisis had a hard hit to all east Asian countries. Based on IMF’s economic analysis, South Korea’s national GDP had grown over 7% per year until 1997, and with linear projection, it was expected that South Korea will catch up western European major economies in early 2010s by per capita GNI. Even after the painful recovery until 2002, per year growth rate was over 5% for another a decade, way above pessimistic economists’ expectation, whose projection was somewhere near Japan’s 1990s, the country nearly stopped growing after the burst of property bubble at the end of 1980s.

The 1970s model worked until 1990s

South Korean economic growth is mostly based on 1970s model that the national government provided subsidy highly export driven heavy industires. The country provide upto 20% of national GDP as a form debt insurnace to Korean large manufacturers for their debt-financing from rich countries. The model worked well up until late 1980s. Economic prosperity by extremely favorable global economic conditions coined as ‘3-Lows (Low Korean won, Low Petro price, Low interest rate)’. The success helped the economy to rely on short-term borrowing from US, Japan, and other major economies until 1997.

Forced to fire-sale multiple businesses at a bargain price, the passion for growth in the country was gone. Large business owners become extremely conservative on new investments. They also turned heads to domestic market, where competitors are small and weak. SMEs have been wiped out by large conglomerates, most of which were incapable of competiting internationally, thus turning to safe domestic battle.

Had time and money, but collective policy failures killed all

Compared to North Korean economic struggle, South Korea has been the symbol of success in capitalism. Over the 50 years, South Korean per capital GNI has grown from US$1,000 to US33,000, while Northern brothers are still struggling with US$1,000 to US$2,000, depending on agricultural production affected by weather conditions. In other words, while North Korea is still in pre-industrialization economy, the South has grown to a major industrial power with lots of cutting edge technological products, including semiconductors by Samsung Electrics and SK Hynix.

The country was able to keep higher than expected growth up until 2020, largely because of China’s massive import. China, since the opening of its economy in 1998 by joing WTO(World Trade Organization). China has been the key buyer of South Korean electric appliances, smartphones, semiconductors, and many other tech products, most of which were crucial for its own economic developement.

But experts have raised attention that China’s technological catch-up was a growingly imminent threat to Korean’s tech superiority. The gap is now mostly gone. Even the US is now raising a bar high against China for ‘security purpose’. The fact that the US has been keen on China’s national challenge to semiconductor industry now even to chem and bio is an outstanding proof that China is no longer a tech follower to western key economic leaders, not to mention South Korea.

US-China trade war expedited Korea’s fall

By a simple Cobb-Douglas model, with capital and labor, it is easy to guess that capital withdrawal from China resulted in massive surplus to the US market, where the economy is suffering from higher than usual inflation. It’s the cost that the US market pays. On the other hand, without capital base, the Chinese economy is going to suffer from capital shock like Asian Financial Crisis of 1997. Facilities are there, but money is gone. Until there is any capital influx to fill the gap, be it by IMF and World Bank like 1997 or long-term internal capital building like Great Britain from 1970s to 2000s, we won’t be seeing China’s economic rise.

The sluggish Chinese economy deadly affected its neighbors. One of the trading partners that were hit hard is South Korea in Asia, Germany in Europe, and Apple in BigTechs. Germany used to be the symbol of economic growth in Europe, at least during European sovereign debt crisis of 2008-2012. Unlike other big tech companies, Apple kept its dependency to China until very recently. The company lost stock values by 40% since the peak in 2022. South Korean story is not that different. The major trading partner zipped its wallet. 15% to 40% of trade surplus, depending on industries, were disappeared. Korean companies were not ready to replace the loss by other sources.

The evident example that South Korea was not ready to China’s withdrawal is its dependency to Aqueous urea solution(AUS) for diesel powered trucks. Over 90%, sometimes upto 100%, of AUS consumption in the nation was from Chinese sources, which was stopped twice recently. In Dec 2021 and Sep 2023, lack of AUS pushed Korea’s large cargo freight trucks being inoperable. The country’s logistic system was nearly shut down. The government tried to replace it for two years from 2021 to 2023, but the country still failed to avoid another AUS crisis in Sep 2023.

For South Korea, China was a mixed blessing. Dependency to China from 1998 upto 2020 helped the economy to keep high enough growth rate to run the country. But heavy dependency now creates detrimental effects to every corner of the country’s industrial base. Simply put, Korea has been too dependent to China.

Education, policy, companies, all failed jointly and simultaneously

Fellow professors in major Korean universities do not expect Korea to rebound anytime soon. The economic growth model that worked in 1970s have not been working as early as late 1990s. The government officials have, however, been ignorant of failing system. Back then, under military regime, only successful business men were given government subsidy. The selection process was tough. Failing businesses were forced to close down, before creating any harm to wider economy.

But the introduction of democratic system that brough freedom to business, press, and civil rights groups deprived the government of total control on resource allocation. The country no longer is operated by a single powerful and efficient planner. While recovering from devastating financial crisis in 1997, every agents in the economy learned that the government is no longer a powerful fatherhood and tasted some economic freedom.

Had the freedom been regulated properly, the economy would have been armed by national support in subsidy, human resources, as well as 50 million domestic customer base. Instead, except a few internationally qualified products, most of them turned their heads inward. For lack of English speaking manpower, companies were not able to compete internationally, unless they have hard and unique products. Building a brand from ‘copying machine’ to ‘tech leader’ costs years of endeavor that we can only see successes in RAM chips and K-pop singers.

Korea had time to renew its economic policy. But Chinese honeyspot provided too much illusion that Korean companies thought its superiority will stay forever. Koreans have kept its ‘copying machine’ policy. The government officials were not as keen as 1970s, thus any sugarcoated success in overseas countries helped Korean companies to be in a position of demand to subsidy. The country stopped grow technologically. Industries, academia, and press become entangled to one goal. Massive exaggeration to earn government subsidy. For one, Korean government wasted US$10 billion just for basic programming courses in K-12 that are no longer needed in the era of Generatvie AI. In the meantime, China was not willing to stay culturally, technologically, and intellectually behind its tiny neighbor that they have looked down for the last two millenia.

While Korean education puts less and less emphasis on math/stat/science, Chinese took opposite steps. Now Korea’s the most demanded college major is medical doctoral track, while Chinese put Mathematics as the top major. Despite higher competition to medical track with large expected income, some students no longer pursue medical track just because they are afraid of high school mathematics and science.

Aging society with lowest birthrate in the world

Will there be any hope in Korea? Many of us see otherwise. The country is dying, literally. The median age of the country is 49.5 as of year 2024. Generations born in 1980s had nearly 1 million babies in a year, while in 2020s they only have 200,000. The population, particularly in working age, will be shrunken to 1/5 in a few decades later. Due to touch economic conditions, young couples push marriage as late as 30s and 40s. Babies by women after 35 have shown some level of genetic defect that even 1/5 of working population won’t be as effective as today.

Together with mis-guided educational policy, the country is expected to have less capable brain as the time goes. International competition will become more severe due to desperate Chinese catch up in technology. Companies have already lost passion for growth.

Economic reforms have been tried, but the unpopular minority seldom wins in elections. Even if it wins, the opposition is too strong to overcome. Officials expect that the country is on a ticking bomb without any immediate means of defusion.

Though I admit that other major economies are suffering from similar growth fatigue, it is at least evident that South Korea is now on the list of ‘no-hope’. If you are looking for growth stocks, go and look for other countries.