Why market interest rates fall every day while the U.S. Federal Reserve waits and why Bitcoin prices continue to rise

When an expectation for future is shared, market reflects it immediately

US Fed hints to lower interest rates in March, which is already reflected in prices

Bitcoin prices also rely on people's belief on speculative demands

The US Fed determines the base interest rate approximately once every 1.5 months, eight times a year. There is no reason for the market to immediately follow the next day when the Federal Reserve sets an interest rate, and in fact, changing the base rate or target interest rate does not mean that it can change the market the next day, but it is a method of controlling the amount of money supplied to general banks, It is common for interest rates to be substantially adjusted within one to two weeks by appropriately utilizing methods such as controlling bond sales volume.

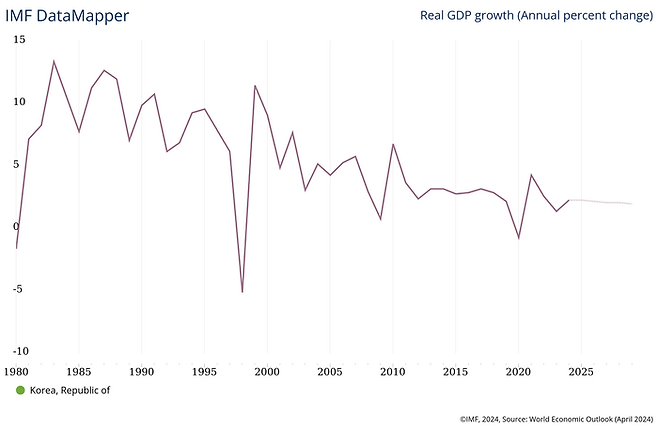

The system in which most central banks around the world set base interest rates in a similar way and the market moves accordingly has been maintained steadily since the early 1980s. The only difference from before was that the money supply was the target at that time, and now the interest rate is the target. As experience with appropriate market intervention accumulates, the central bank also learns how to deal with the market, and the market also changes according to the central bank’s control. The experience of becoming familiar with interpreting expressions goes back at least 40 years, going back as far as the Great Depression in the United States in 1929.

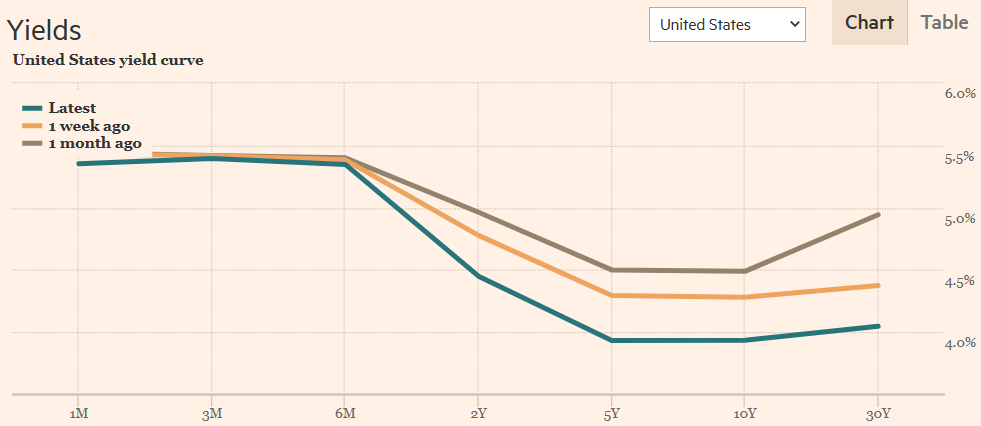

However, the Federal Reserve declared that it is not time to lower interest rates yet and that it will wait until next year, but interest rates at commercial banks are lowering day after day. I briefly looked at the changes in US interest rates in the Financial Times, and saw that long-term bond interest rates were falling day by day.

Why is the market interest rate lowering while the Federal Reserve remains silent?

Realization of expectations

Let’s say that in one month, the interest rate falls 1% from now. Unless you need to get a loan tomorrow, you will have to wait a month before going to the bank. No, these days, you can send documents through apps and non-face-to-face loans are also active, so you won’t have to open your banking app and open the loan menu for a month.

From the perspective of a bank that needs to make a lot of loans to secure profitability, if the number of such customers increases, it will have to suck its fingers for a month. What happens if there is a rumor that interest rates will fall further in two months? You may have to suck only your fingers for two months.

Let’s put ourselves in the position of a bank branch manager. In any case, it is expected that the central bank will lower interest rates in a month, and everyone in the market knows that, so it is not a post-reflection where interest rate adjustments are hastily made in the market after the central bank announcement, but everyone is not interested in the announcement date. If it is certain that it will be reflected in advance, there will be predictions that the market interest rate will be adjusted sooner than one month. Since you have worked your way up to the branch manager level, you clearly know how the industry is going, so you can probably expect to receive a call from the head office in two weeks to lower the interest rate and ask for loans and deposits. However, the only time a loan is issued on the same day after receiving the loan documents is when the president’s closest aide comes and makes a loud noise. Usually, more than a week is spent on review. There are many cases where it takes 2 weeks or 1 month.

Now, as a branch manager with 20+ years of banking experience who knows all of this, what choice would you make if it was very certain that the central bank would lower interest rates in one month? You have to build up a track record by giving out a lot of loans to be able to look beyond branch manager, right? We have to win the competition with other branches, right?

Probably a month ago, he issued an (unofficial) work order to his branch staff to inform customers that loan screening would be done with lower interest rates, and while having lunch with wealthy people nearby, he said that his branch would provide loans with lower interest rates, and talked to good people around him about it. We will introduce you to commercial buildings. They say that you can make money if you buy something before someone else does.

When everyone has the same expectation, it is reflected right now

When I was studying for my doctorate in Boston, there was so much snow in early January that all classes were cancelled. Then, in February, when school started late, a professor emailed us in advance to tell us to clear our schedules, saying that classes would be held on from Monday to Friday.

I walked into class on the first day (Monday), and as the classmates were joking that we would see each other every day that week, and the professor came to the classroom. And then to us

I’m planning to take a ‘Surprise quiz’ this week.

We were thinking that the eccentric professor was teasing us with strange things again. The professor asked again when they would take the surprise quiz. For a moment, my mind raced: When will be the exam? (The answer is in the last line of the explanation below.)

If there is no Surprise Quiz by Thursday, Friday becomes the day to take the Quiz. It’s no longer a surprise. So Friday cannot be the day to take the Surprise quiz.

What happens if there is no surprise quiz by Wednesday? Since Friday is not necessarily the day to take the Surprise quiz, the remaining day is Thursday. But if Friday is excluded and only Thursday remains, isn’t Thursday also a Surprise? So it’s not Thursday?

So what happens if there is no Surprise quiz by Tuesday? As you can probably guess by now, Friday, Thursday, Wednesday, and Tuesday do not all meet the conditions for Surprise by this logic. What about the remaining days?

It was Monday, right now, when the professor spoke.

As explained above, we are told to take out a piece of paper, write our names, write an answer that logically explains when the Surprise quiz will be, and submit it. I had no idea, but then I suddenly realized that the answer I had to submit now was the answer to the Surprise quiz, so I wrote the answer above and submitted it.

The above example is a good explanation of why the stock price of a company jumps right now if you predict that the stock price of that company will rise fivefold in one month. In reality, the stock market determines stock prices based on the company’s profitability over two or three quarters, not on its profitability today. If the company is expected to grow explosively during the second or third quarter, this will be reflected in advance today or tomorrow. The reason it is delayed until tomorrow is due to regulations such as daily price limits and the time it takes to spread information. Just as there is a gap between students who can submit answers to test questions right away and students who need to hear explanations from their friends after the test, the more advanced information is, the slower its spread may be.

Everyone knows this, so why does the Fed say no?

Until last October and November, at least some people disagreed with the claim that an interest rate cut would be visible in March of next year. As there is growing confidence that the US will enter a recession in December, there is now talk of lowering interest rates at a meeting on January 31st rather than in March. Wall Street financial experts voted for a possibility that was close to 10%, which was only 0% just a month ago. Meanwhile, Federal Reserve Chairman Powell continues to evade his comments, saying that he cannot yet definitively say that he will lower interest rates. We all know that even if we don’t know about January, we are sure about March, but he has much more information than us, and there are countless economics doctors under him who will research and submit reports, so why does he react with such ignorance? Should I do it?

Let’s look at another example similar to the Surprise quiz above.

When the professor entered the first class of the semester, he announced that the grade for this class would be determined by one final exam, and that he planned to make it extremely difficult. Many students who were trying to earn credits day by day will probably escape during the course adjustment period. The remaining students have a lot of complaints, but they still persevere and listen carefully to the class, and later on, because the content is too difficult, they may form a study group. Let’s imagine that it’s right before the final exam and your professor knows that you studied so hard.

The professor’s original goal was for students to study hard, not to harass them by giving difficult test questions. Writing tests is a hassle, and grading them is even more bothersome. If you have faith that the remaining students will do well since you kicked out the students who tried to eat raw, it may be okay to just give all the remaining students an A. Because everyone must have studied hard.

When I entered the exam room,

No exam. You all have As. Merry Christmas and Happy New Year!

Isn’t it written like this?

From the students’ perspective, they may feel like they are being made fun of and that they feel helpless. However, from the professor’s perspective, this decision was the best choice for him.

- Students who tried to eat it raw were kicked out.

- The remaining students studied hard.

- Reduced the hassle of writing test questions

- You don’t have to grade

- When entering your grade, you only need to enter the A value.

- No more students complaining about grading.

The above example is called ‘Time Inconsistency’ in game theory, and is often used as a general example of a case where the optimal choice varies depending on time. Of course, if we continue to use the same strategy, ‘students who want to eat raw’ will flock to register for the next semester. So, in the next semester, you must take the exam and become an ‘F bomber’ who gives a large number of F grades. At a minimum, students must use the Time Inconsistency strategy at unpredictable intervals for the strategy to be effective.

The same logic can be applied to Federal Reserve Chairman Powell. Although interest rates are scheduled to be lowered in March or January next year, if they remain silent until the end, it could reflect their will to prevent overheating of the economy by raising interest rates. Then, if interest rates are suddenly lowered, an economic recession can be avoided.

Those who do macroeconomics summarize this with the expressions ‘discretion’ and ‘rules.’ ‘Discretion’ refers to government policy that responds in accordance with market conditions, and ‘rules’ refers to a decision-making structure that ignores market conditions and moves in accordance with standard values. Generally, a structure that promotes ‘rules’ on the outside and uses ‘discretion’ behind the scenes. has worked like a market rule for the past 40 years.

Because of this accumulated experience, sometimes the central banker sticks to the ‘rules’ until the end and devises a defensive strategy so that the market does not expect ‘discretion’, and sometimes he comes up with a strategy to respond faster than the market expects. These are all choices made to show that market expectations are not unconditionally followed by using Time Inconsistency or vice versa.

Examples

Such cases of surprise quizzes and no exams can often be found around us.

Although products like Bitcoin are nothing more than ‘digital pieces’ with no actual value, there are some people who have a firm belief that it will become a new currency replacing the central government’s currency, and some who are not sure about currency and just buy it because the price goes up. Prices fluctuate repeatedly due to the buying and selling actions of the (overwhelming) majority of like-minded investors. The logic of a surprise quiz is hidden in the behavior of buying because it seems like it will go up, and in the attitude of never admitting it and insisting on the value until the end, even though you know in your heart that it is not actually worth it, there is a central bank-style strategy using no exam hidden. .

The same goes for the behavior of ‘Mabari’, a so-called securities broker who raises the stock price of theme stocks by creating wind, and the sales pitch of academies that say you can become an AI expert with a salary in the hundreds of millions of dollars by simply obtaining a code is also the same. They all cleverly exploit the asymmetry of information, package tomorrow’s uncertain value as if it is great, and sell today’s products by inflating their value.

Although it is not necessarily a case of fraud, cases where value is reflected in advance are common around us. If the price of an apartment in Gangnam looks like it will rise, it rises overnight, and if it looks like it will fall, it moves several hundred million won in a single morning. This is because the market does not wait and immediately reflects changed information.

Of course, this pre-reflected information may not always be correct. You will often hear the expression ‘over-shooting’, which refers to a situation where the market overreacts and stock prices rise excessively, or real estate prices fall excessively. There may be many reasons, but it happens because people who follow what others say and brainwash their brains do not accurately reflect the value of information. Generally, in the stock market, if there is a large rise for one or two days, the stock price tends to fall slightly the next day, which is a clear example of ‘overshooting’.

Can you guess when the interest rate will drop?

Whenever I bring up this topic, the person who was dozing off wakes up at the end and asks, ‘Please tell me when the interest rate will go down.’ He says he can’t follow complicated logic, he just needs to know when the interest rate goes down.

If you have been following the story above, you will be predicting that interest rate adjustments will continue to occur in the market between the Christmas and New Year holidays before the central bank lowers interest rates. It is unclear whether the decision to lower interest rates will be made on January 31 or March 20 next year. Because it’s their heart. Economic indicators are just numbers, and ultimately, they are values that only move when people make decisions that risk their future reputations, but I can’t get into their minds.

However, since they also have the rest of their lives, they will try to make rational decisions, and those who are smart enough to solve the Surprise quiz on the spot will adjust their expectations the fastest and become market readers, and those who solve the problem will become the market readers. People who have heard of it and know about it will miss the opportunity due to the information time lag, and people who ask ‘just tell me when it will arrive’ will only respond belatedly after the whole incident has occurred. While you’re sending emails asking who’s right, you’ll find out later that the market correction is over. To paraphrase, it is already coming down. The 30-year maturity bond interest rate, which was close to 5.0% a month ago, fell to 4.0%?